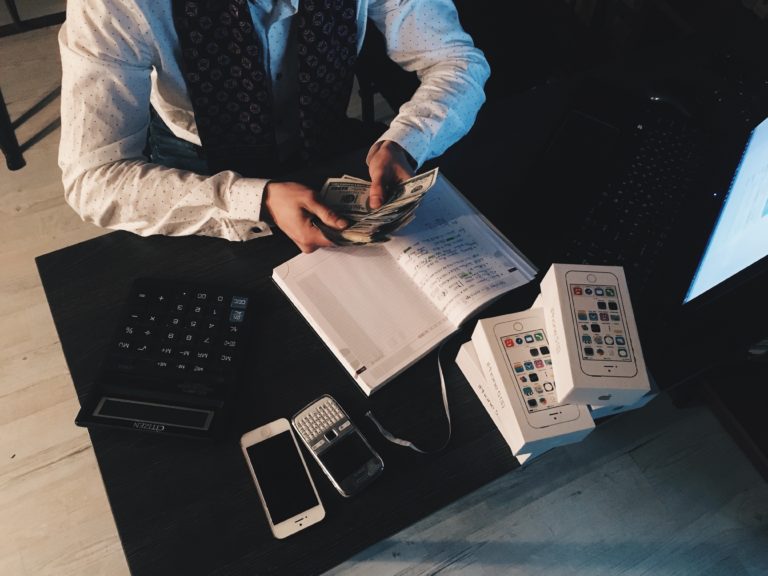

Managing finances effectively is the biggest challenge faced by small businesses. For new businesses, managing finances feels like a burden, a chore. This could lead to bad financial decisions and habits, thus ending up harming your business.

What should you do?

The only way of dealing with expenses is educating oneself. Once you learn the basic skills required for running a small business, planning finances would not feel like burden anymore. Such skills include accounting tasks, preparing financial statements, applying for business loans and several others.

Tricks and tactics to improve your finances:

So, here are some steps you can take as the owner of a small business to control your finances like a pro:

- Pay yourself- Extra capital can be of great help in times of crisis or while expanding your business. If you own a small business, saving money becomes challenging as might need to put everything into daily operations. So, you might forget to pay yourself amidst all the stress. Keep in mind that you are a valuable part of your business and you must compensate yourself besides paying others.

- Invest money in growth- You have to keep money aside and invest it in growth opportunities. This will help the business grow, thus strengthening your finances in the future. Employees appreciate when the company invests in its growth and their growth. Customers appreciate good services. So, in the long run, you crater value for the business of yours.

- Practice healthy financial habits- Establishing good financial protocols is a must for startups and small businesses. Small businesses have to deal with multiple limitations in terms of technology, money, and infrastructure. So, the owner should have strong control over employees for increasing productivity. If the internal control is weak, it can even get you into serious legal problems.

- Monitor cash flow- Managing finances like an experienced man also means being able to monitor cash flow is to make sure that on a daily basis, your business is running at a healthy level. Too much unpaid invoices can give birth to cash flow troubles, a primary reason behind failure of small businesses. If you have late-paying clients, calling and messaging them will not work. Instead, lure them with discounts if they pay early.

- Distribute tax payments evenly- If it is troublesome to save for quarterly estimated payments of tax, why not opt for monthly payment? This way, you will be able to look at tax payments as another monthly operational expenditure, just like several others.

- Plan in advance- You’ll always face business issues that demand immediate attention. But, as far as finances are concerned, you have to prepare in advance. In you fail to do so you’ll lag behind your competitors.

Conclusion:

Instead of ignoring the job and getting overwhelmed with receipts at the year end, realize the importance of tracking financial information all the year round. Always remember that staying organized is the key to handling money effectively. Follow the above-mentioned suggestions and you’ll feel confident to manage finances single-handedly.